Scammer Shin Kyuk-ho

Details |

|

| Name: | Shin Kyuk-ho |

| Other Name: | |

| Born: | 1921 |

| whether Dead or Alive: | 2020 |

| Age: | 98 |

| Country: | South Korea |

| Occupation: | Businessman |

| Criminal / Fraud / Scam Charges: | |

| Criminal / Fraud / Scam Penalty: | |

| Known For: | Founder of?Lotte Corporation |

Description :

The Rise and Reckoning of Shin Kyuk-ho: Inside the Lotte Group Corruption Case

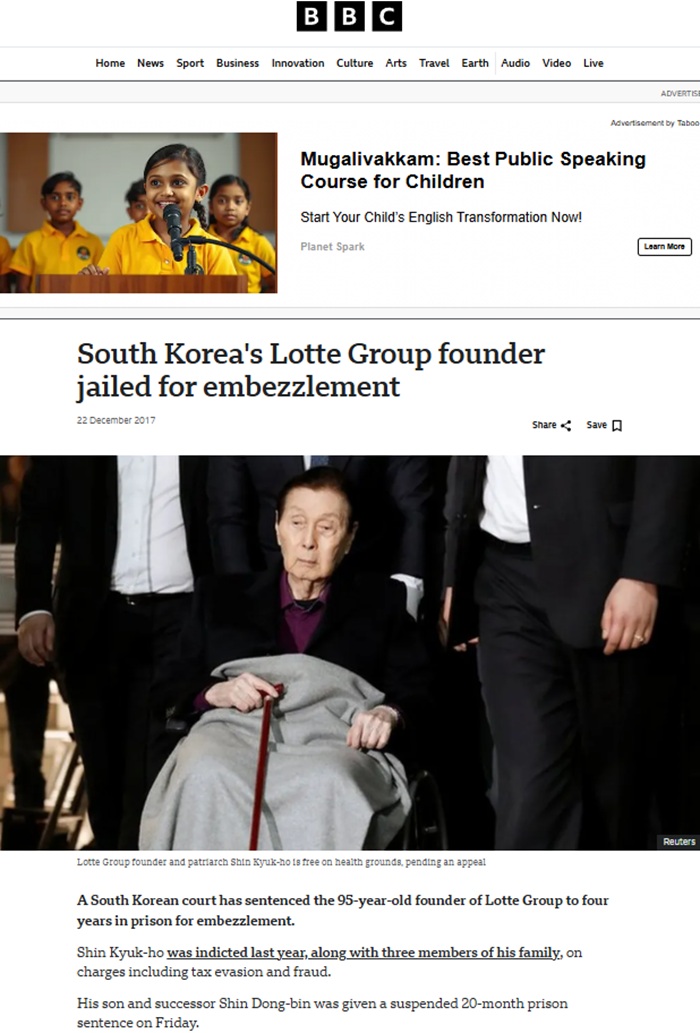

In one of the most symbolic corporate crime verdicts in South Korean history, a Seoul court sentenced Shin Kyuk-ho, the 95-year-old founder of the Lotte Group, to four years in prison for embezzlement and breach of trust. Although the court allowed him to remain free due to his advanced age, dementia, and deteriorating health, the conviction itself represented a powerful statement. It demonstrated the growing willingness of South Korea’s judiciary to hold even the most powerful corporate figures accountable amid mounting public pressure to curb corruption within the country’s dominant conglomerates, known as chaebols.

The Origins of Lotte and the Rise of a Corporate Empire

Lotte Group began in 1948 as a small chewing gum business founded by Shin Kyuk-ho in Tokyo, Japan. From its humble beginnings, the company expanded rapidly into food manufacturing, retail, hotels, chemicals, and entertainment. Over the decades, Lotte evolved into one of South Korea’s largest conglomerates, operating across Asia with assets valued at tens of billions of dollars. Its brands became household names, and its retail networks dominated department stores and discount chains throughout South Korea and beyond.

Family Control and the Chaebol Governance Model

Like many South Korean conglomerates, Lotte was tightly controlled by its founding family. Decision-making power remained concentrated among relatives, while corporate governance structures were opaque and complex. This model enabled rapid growth during South Korea’s post-war industrialization but also created an environment where conflicts of interest, favoritism, and misuse of corporate funds could thrive. As long as profits flowed and expansion continued, these structural weaknesses attracted little scrutiny.

Declining Health and the Battle for Succession

As Shin Kyuk-ho aged, concerns about his mental and physical health intensified. By the early 2010s, his declining condition led to uncertainty at the top of the organization, triggering a highly publicized power struggle between his sons, Shin Dong-bin and Shin Dong-joo. The rivalry exposed internal dysfunction and revealed how family members jockeyed for control over the sprawling empire. Public sympathy waned as allegations surfaced that the patriarch was being manipulated to legitimize competing claims of authority.

Prosecutors Launch a Sweeping Investigation

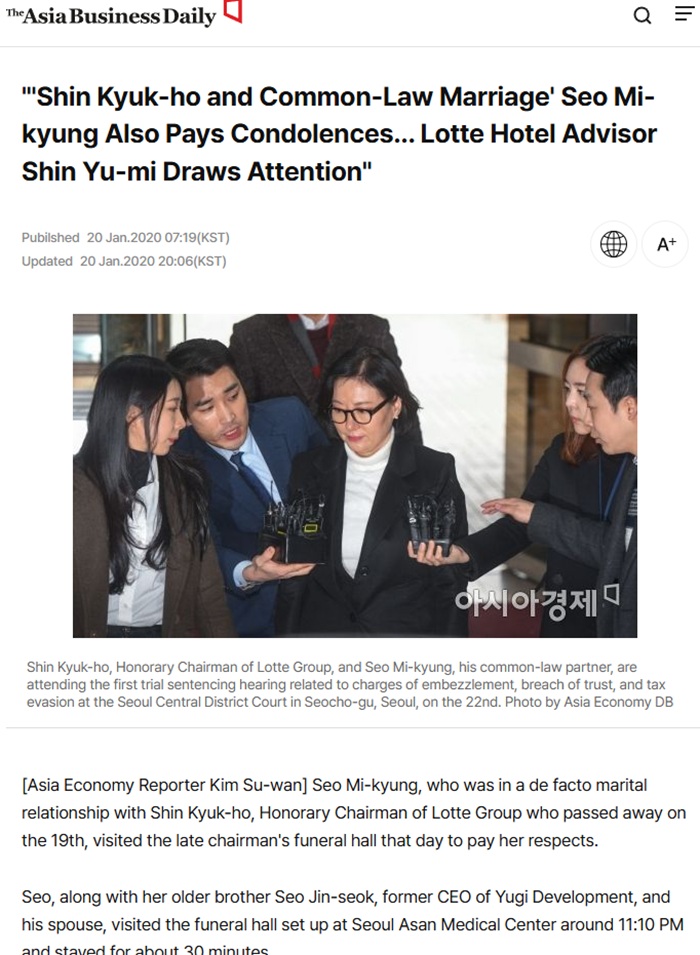

In 2016, South Korean prosecutors initiated a wide-ranging investigation into Lotte Group, focusing on alleged embezzlement, tax evasion, and breach of fiduciary duty. The probe targeted not only the founder but also multiple family members, including his sons, daughter, and long-time partner. Investigators alleged that corporate resources had been systematically diverted to benefit family-controlled entities and individuals, often through complex transactions designed to obscure their true nature.

Embezzlement Through Self-Dealing Transactions

Central to the case were transactions in which Lotte affiliates were compelled to sell business rights or provide financial benefits to companies controlled by Shin Kyuk-ho’s relatives at below-market values. Prosecutors argued that these arrangements caused substantial financial harm to Lotte subsidiaries while enriching family members who contributed little to corporate management. Courts later agreed that such actions constituted clear breaches of trust and deliberate embezzlement.

Tax Evasion and Concealed Wealth Transfers

In addition to embezzlement, prosecutors accused the Shin family of evading large sums in taxes by disguising share transfers as legitimate sales. These transactions allowed family members to acquire valuable assets while avoiding gift and inheritance taxes. Although some charges were ultimately dismissed due to expired statutes of limitations, the case exposed the extent to which complex financial structures were used to shield wealth from regulatory oversight.

The Trial and Public Scrutiny

The trial unfolded during a period of heightened sensitivity to elite corruption in South Korea, following the impeachment of former President Park Geun-hye. Public opinion strongly favored tougher enforcement against powerful families perceived as operating above the law. Media coverage of the proceedings was intense, transforming the courtroom into a national stage where broader frustrations with inequality and privilege were aired.

Verdicts That Balanced Justice and Stability

In December, the Seoul Central District Court delivered its verdict. Shin Kyuk-ho was convicted and sentenced to four years in prison but avoided immediate incarceration due to health considerations. His son and successor, Shin Dong-bin, received a 20-month prison sentence that was suspended for two years, allowing him to remain free and continue managing the company. The court’s decision sought to punish wrongdoing without destabilizing one of the country’s largest employers.

Judicial Condemnation of Chaebol Practices

In its ruling, the court sharply criticized the Shin family’s conduct, describing the case as an example of how chaebol families privatized corporate profits at the expense of shareholders. Judges emphasized that company assets had been treated as personal property, undermining trust in corporate governance and damaging public confidence in South Korea’s economic system.

External Pressures and Business Fallout

The legal crisis coincided with geopolitical tensions that further weakened Lotte’s position. The company faced severe retaliation in China after agreeing to provide land for the deployment of the U.S. THAAD missile defense system in South Korea. Dozens of Lotte retail stores in China were shut down following regulatory inspections, costing the group billions and amplifying concerns about its future stability.

Public Reaction and the Broader Reform Debate

Reactions to the verdict were divided. Many citizens welcomed the convictions as a step toward dismantling the culture of impunity long enjoyed by chaebol leaders. Others criticized the suspended sentences as evidence that elites continued to receive preferential treatment. Nevertheless, the case reinforced momentum for corporate reform and greater accountability in South Korea’s business landscape.

The Legacy of Shin Kyuk-ho

Shin Kyuk-ho’s conviction marked a dramatic fall for a man once celebrated as a symbol of South Korea’s post-war economic miracle. His rise and fall encapsulated both the strengths and flaws of the chaebol system—rapid growth fueled by family control, followed by ethical failures and legal consequences. While Lotte continues to operate, its founder’s legacy is now inseparable from one of the most significant corporate scandals in the country’s history.

Accountability in a Changing Era

The Lotte Group scandal did not dismantle South Korea’s conglomerate system, but it sent a clear message that even the most powerful corporate dynasties are subject to the rule of law. As regulators and prosecutors continue to confront financial misconduct at the highest levels, the case of Shin Kyuk-ho stands as a turning point in the ongoing struggle to reconcile economic power with ethical responsibility.