Inheritance Scams

Business houses may lose their operations and outside contacts when they lack access to the internet, emails, and social websites. In this competitive environment, businesses can grow significantly only when they engage with their target group through social marketing on online platforms. In the last few years, hundreds of companies have sold millions of products to customers worldwide solely through their official websites. Thanks to the internet and email technology, which have become a savior for the corporate world and common people alike. Though many people use the internet and email wisely, there are scammers silently swindling money from innocent victims by obtaining their credit card and other financial details through reply emails. Scams related to inheritance are on the rise, particularly those carried out via email. The concerned authorities should take immediate action to apprehend the culprits and charge them under various criminal sections.

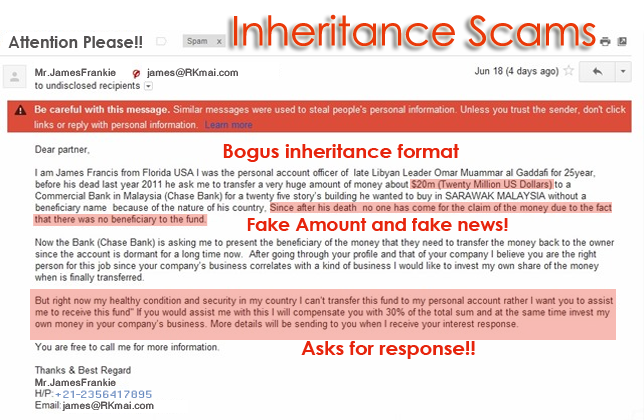

In the past, regular mail users received letters related to inheritance and escalated these scams to the concerned authorities. Scammers would disguise themselves as lawyers or attorneys and send a message stating that a wealthy individual, who owned a multi-million-dollar estate, had recently passed away without leaving a will. They would claim that the government had decided to disburse the money to the public immediately. The message would go on to say, “Anyone willing to receive the amount should provide their account details, such as account number, PIN, and password, for transferring the funds to their respective accounts.” Innocent victims, believing the story, would share these details and quickly lose their money. Scams related to inherited checks are closely linked to these schemes. In such cases, a scammer poses as a bank executive and sends an email claiming that the bank is planning to clear an unclaimed check worth several million dollars through a lucky draw system. Those who wish to receive the amount are instructed to provide their account number, banking password, and PIN. People who receive such messages may believe them and respond with their details. After collecting this information, the scammers siphon money from the victims’ accounts. Inheritance letter scams are also becoming widespread. These scams involve deceptive tactics where individuals are falsely led to believe they are entitled to a substantial inheritance. Typically initiated through emails, letters, or phone calls, scammers claim to represent the estate of a deceased relative or unknown benefactor. Victims are informed of an unexpected inheritance but are asked to pay upfront fees—such as legal costs or taxes—to facilitate the transfer. These scams often use pressure tactics, urging immediate action to prevent victims from verifying the legitimacy of the claim. To avoid falling victim, individuals should independently verify inheritance claims, consult legal professionals, be skeptical of upfront payments, confirm the identities of those involved, and stay informed about common scam tactics. Reporting any suspected inheritance scams to the authorities is crucial in preventing further financial loss or identity theft.

Scammers often pose as bank officials and craft imaginary letters that appear highly formal and error-free, then send them to multiple email addresses. The contents of these letters typically state something like: “A wealthy individual who deposited millions of dollars in our bank has died suddenly without leaving a will. The court has decided to disburse the money to people who are in distress and poverty. Any common person facing financial hardship is eligible and should provide their banking details for the transfer.” Recipients of such emails may believe the message is official and respond by providing their banking details. The criminals on the other end then siphon off money from their accounts. Scammers may also create forged versions of bank deposit certificates—designed to look genuine—and mail them to several people. Many recipients, deceived by the professional appearance of these documents, may assume they are authentic and share their personal banking information. Therefore, the public should never respond to such unsolicited messages or provide personal and financial details to unknown sources.

Inheritance scams are deceptive schemes in which individuals are targeted with false promises of substantial inheritances. Typically initiated through emails, letters, or phone calls, scammers pose as lawyers, estate representatives, or officials handling the affairs of a deceased individual. Victims are informed of an unexpected inheritance—often from a fictitious distant relative or unknown benefactor—and are instructed to pay upfront fees, such as legal costs, taxes, or administrative charges, to facilitate the release of the supposed inheritance. By using pressure tactics and creating a sense of urgency, scammers aim to prevent victims from verifying the legitimacy of the claim. In reality, there is no inheritance, and once the victim pays the fees, the scammers disappear. To avoid falling victim to inheritance scams, individuals should independently verify such claims through legal channels, consult trusted professionals, be skeptical of requests for upfront payments, confirm the identities of all parties involved, and stay informed about common scam tactics. Reporting suspected inheritance scams to the authorities is essential to prevent further financial loss and identity theft.