Institutional Investment Scams

Scams that are related to institutional investment are becoming the talk of the town. In these types of scams the scammers will target the small institutions like colleges, schools, small firms and mid-sized firms and swindle their money by sending phishing mails. Scammers will pose themselves as investment consultant or intermediary and try to extract money from the small institutions or corporations. When these institutions believe the words of these scammers and deposit their money the scammers will run away with it in a flash of a second. These scammers will lure the money from the institutions by following traditional or other modern methods. The methods they follow may include share sale fraud, pyramid or ponzi schemes and pension types of frauds. The scammers will use attractive words in their mails or letters and will try to play their game wonderfully.

Institutional investment scams are elaborate and deceptive schemes specifically targeting entities such as pension funds, endowments, and large investment firms. These scams exploit the intricate nature of institutional investments, often involving substantial sums of money. Perpetrators of institutional investment scams employ a variety of tactics, including presenting false investment opportunities with promises of exceptionally high returns. They may use sophisticated fraud schemes, such as complex financial instruments or convoluted investment strategies, to mislead institutional investors. Impersonation of reputable financial institutions, fund managers, or investment professionals is another common tactic to gain the trust of these sophisticated investors. Phishing attacks, where scammers use deceptive emails or communications to compromise accounts or extract sensitive information, are also prevalent. Additionally, some institutional investment scams operate as Ponzi schemes, using funds from new investors to pay returns to earlier participants.

In the past hundreds of small firms were cheated by the scammers and the estimated losses were around thousands of dollars. Institutions should delete these types of phishing mails immediately after reading and they should also escalate the matter to the police or cyber cell. There are lots of famous scams that are related to institutional investments have happened in the past in the country of the USA and the corporate houses should show caution while opening the mails from the third parties. Scammers in order to lure from the public will offer attractive rate of interests when they deposit their money. These are only imaginary words since their main objective is to swindle their money.

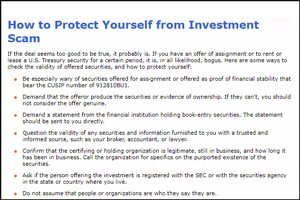

These scams often involve high-pressure tactics to expedite investment decisions without allowing for proper due diligence. To protect against institutional investment scams, it is imperative for institutional investors to conduct thorough due diligence, independently verify the legitimacy of investment opportunities, and establish secure communication channels. Seeking independent verification from reputable sources, financial analysts, or regulatory bodies is crucial in navigating the complex landscape of institutional investments. Institutional investors should prioritize ongoing education for their staff, ensuring they are well-versed in recognizing and preventing investment scams. It is essential to foster a culture of skepticism and diligence to detect red flags and mitigate risks associated with these scams. Reporting any suspected fraudulent activity to relevant financial authorities helps protect the integrity of institutional investments and contributes to the broader effort in combating financial fraud. In an environment where financial sophistication is a necessity, institutional investors must remain vigilant, adaptive to evolving scam tactics, and committed to maintaining the highest standards of security and due diligence to safeguard their assets and uphold the trust placed in them by stakeholders.

- Show caution while opening the mails from third parties and foreign countries.

- Scammers will generally attract the customers by providing false promises and high rates of interest for the investment they make. Never believe their mails or words and do thorough background verification.

- Bankers or other financial institutions that accepts funds from the public will only provide nominal rate of interest. So, of someone is offering higher rate of interests then it is must be a phishing mails.

- Never share their vital information such as password, PIN, SSN and bank account details to anyone. Escalate these types of scamming activities to the police immediately.